BLS E-Services Soars: Hold or Sell? A Professional Take

Stellar Listing, But Should You Hold On?

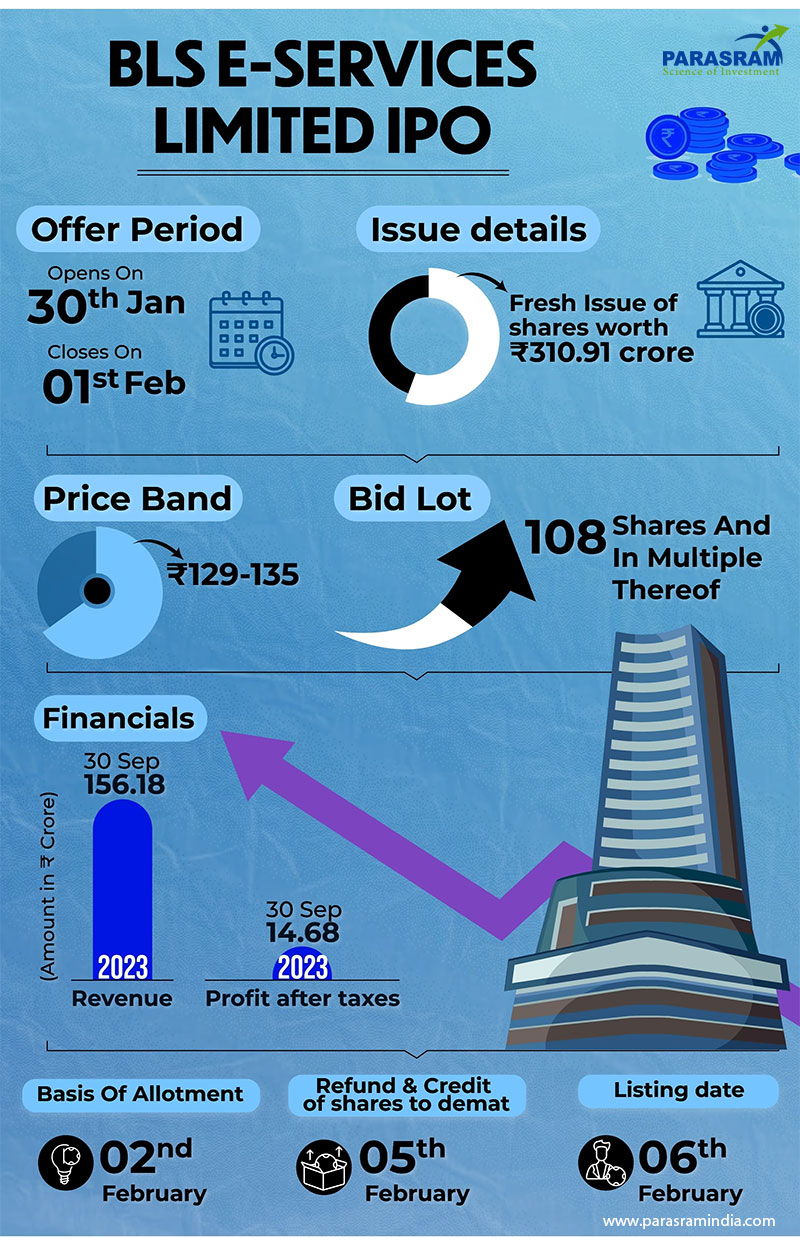

BLS E-Services made a remarkable debut on the stock market, surging 172% above its IPO price. While this might have investors excited, the question remains: hold or sell?

Key takeaways:

- Strong Listing: Shares opened at a 140% premium and continued climbing, currently trading 172% higher than the issue price.

- Oversubscribed IPO: The high demand (over 100x subscription) reflects investor confidence, thanks to strategic pricing.

- Solid Foundation: BLS boasts long-standing partnerships with leading banks, ensuring recurring revenue and operating in a high-growth market fueled by digitization.

- Expert Advice: Partial profit booking is suggested (e.g., 50%) for early investors, while new investors should wait for a price correction.

Company Profile:

BLS E-Services leverages technology to provide:

- Business correspondent services to major Indian banks.

- Assisted e-services and e-governance services at the grassroots level.

- Access points for essential services (utilities, social welfare, healthcare, finance, education, agriculture, banking) for governments, businesses, and consumers.

Financial Performance:

- FY23 saw a 151% YoY income jump to Rs 246 crore and a 278% profit rise to Rs 20.33 crore.

- As of September 2023, income reached Rs 158 crore with a profit of Rs 14.68 crore.

Investment Decision:

- Existing investors with allotments can consider partial booking, but a long-term hold is also an option.

- New investors should watch for a price correction before entering the market.

Remember: This is not financial advice. Conduct your own research and consult a financial advisor before making investment decisions.